We understand lower income individuals face loads of pressures, but we beat to assist everyone see its dream having a workable, economically responsible financing

Low income standing does not have to ban you from having your residence, and it shouldn’t push your with the an under best financial.

We provide of several mortgage choice

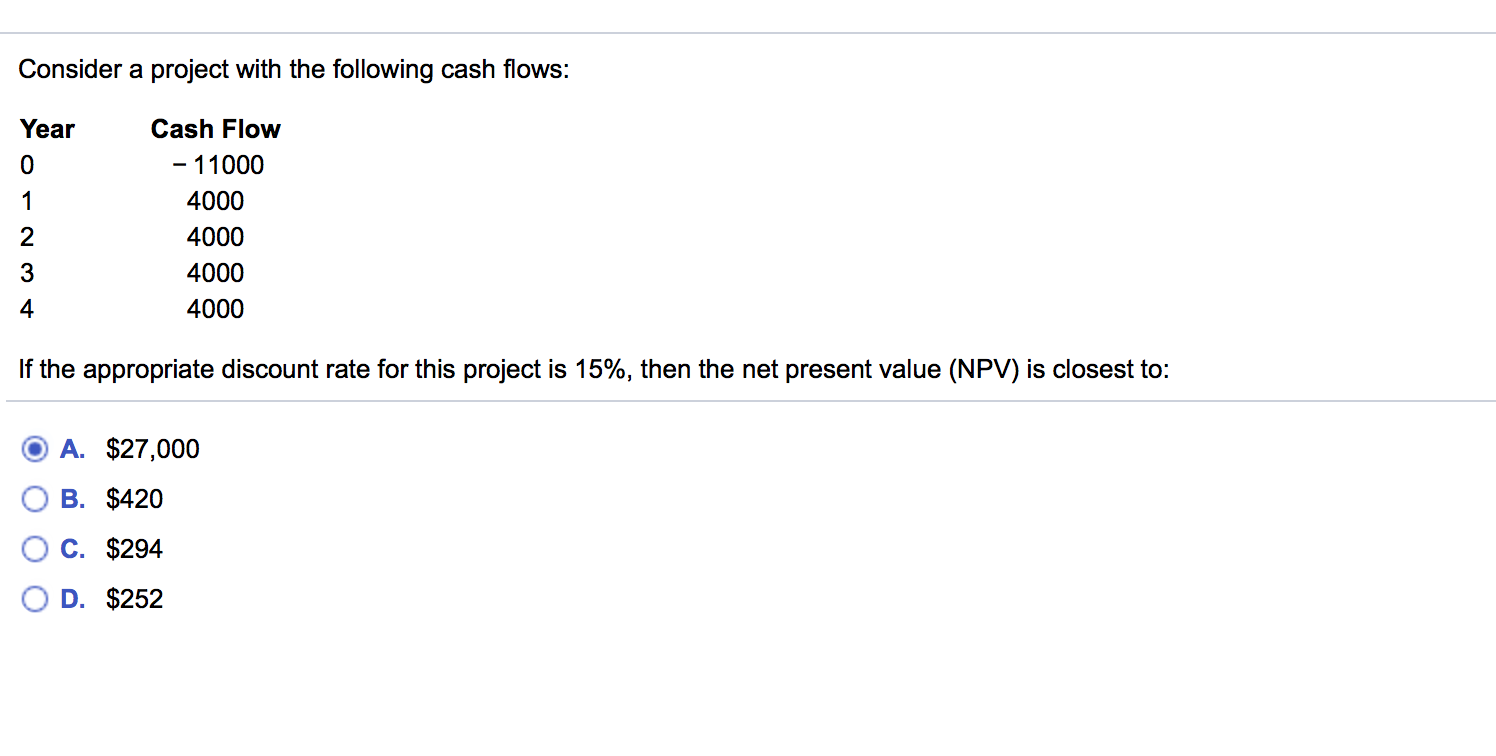

- Get a concept of just what money you want. Get this your first step. Look online to ascertain what the typical house on the town will cost you. Bringing one just like the baseline, make use of the online home loan calculator out-of Quality Lenders observe just what a mortgage might look such to you. Remember this try a price and you can mortgage rates changes within when.

- Determine what your location is. Collect all your valuable monetary pointers, including your most recent pretax earnings, all your expenditures, and you will what you has for the discounts, expenditures, or other property. When you are at the they, calculate their DTI of the dividing the full of the many expenses their owe by the pretax income. Fundamentally, get your credit file. Lower income does not immediately suggest a decreased credit rating. Most mortgage loans need a credit history anywhere between 580 and you may 670. The better the financing rating, the higher your own rate of interest shall be.

- Find out if you qualify for guidelines. There was a spin you qualify for advance payment recommendations, home buying has, or provider-reduced settlement costs.

- Uncover what options are readily available. Not absolutely all mortgage loans have a similar standards. Non-traditional fund (people supported by the installment loan Magnolia federal government) are created to work with lower income consumers and usually succeed quicker down money and higher DTIs. Very traditional money (those individuals not supported by the us government) do not have money constraints, and lots of provides even more advantages like no credit rating requisite, solution advance payment supplies, otherwise higher self-reliance in income qualification.

You can expect of numerous mortgage possibilities

- FHA fund. Government-supported money that allow an excellent step 3.5% deposit, large DTI proportion limits, and fico scores only 580.

- USDA finance. Federally-insured funds especially for low-to-typical income individuals. Money should be lower than a certain tolerance (115% of your average city average income). The new PMI fee is only 0.35%, and you can certain household fixes will likely be as part of the loan amount.

- Virtual assistant finance. To own qualifying active, retired, or honorably released armed forces employees as well as their partners. They don’t require the absolute minimum deposit.

- HomeReady Home loan. A traditional mortgage from Federal national mortgage association, one of the greatest dealers from inside the mortgage loans. The amount of money of every people residing in the house is included, expands your own DTI, and needs as little as good step three% deposit.

Make certain all of your current research is on just the right track. From the Caliber Mortgage brokers, our company is excited about delivering homeownership in order to as many individuals that you can. We have likely one that’s correct or you.

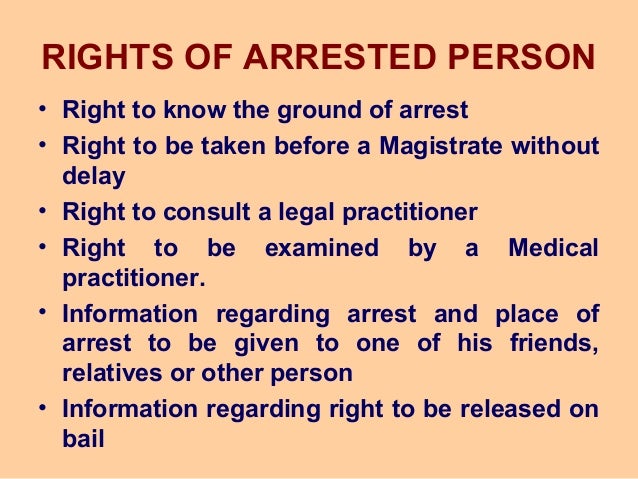

Dealing with a foreclosures was a raw, gloomy sense. They injuries your own borrowing as well as your count on. Having patience and effort, you could get well, defeat during the last, and own a house again. It entails date. It will require really works and you can discipline. By using suitable tips, you will have indicated you are ready to consider home financing mortgage.

You can expect many mortgage loan alternatives

- Show patience. It requires going back to their credit along with your economic fitness to recuperate after a foreclosure. Expect it when deciding to take around three so you can seven ages to suit your borrowing from the bank to change, barring any extra monetary setbacks. Eight decades is even the average waiting months needed for consumers in order to regain eligibility.

- Routine healthy economic designs. What you do to improve your borrowing from the bank and you will economy often get you anywhere near this much closer to borrowing from the bank qualifications again. Take care of steady employment and you will pay down as much loans to. End taking on this new loans and you will refrain from and then make higher commands. Keep up with your debts and outlay cash punctually.