Traditional Mortgages against. Reverse Mortgage loans: What’s the Variation?

For many individuals who wish to individual a house 1 day, delivering a classic financial will get its only choice. Yet not, the usa is under a bona-fide house growth with increasing home values. Therefore, an enormous part of the populace is only able to manage to hold off to own market drama so you’re able to be eligible for a classic home loan of the lending company. And more than of young generation’s moms and dads is actually continuing to pay because of their mortgage balance to their late 1960s.

Of many personal lenders or other creditors today give opposite mortgage loans so you’re able to fill a market demand for affording property and you can navigating later years way of life getting older people. In this article, o ur reverse home loan professionals in the Smartfi Mortgage brokers will explain the essential difference between old-fashioned mortgage loans and you can reverse mortgages.

The opposite mortgage loan means among latest products in the credit community. They were produced on the late eighties and also the very first FHA-insured HECM are issued when you look at the 1989. In comparison, the conventional 30yr repaired was commercially licensed of the Congress regarding the late 1940s. Comparable to growing monetary tool, such cryptocurrency and different lines of credit, the real estate field has received a healthier skepticism regarding the its validity.

What is a traditional Financial?

Antique or traditional mortgage loans have been around permanently, but taking out an opposing home mortgage is uncommon until early 2000s.

A normal mortgage are a conforming financing, for example they meets the particular financing and you can underwriting requirements from Federal national mortgage association otherwise Freddie Mac computer.

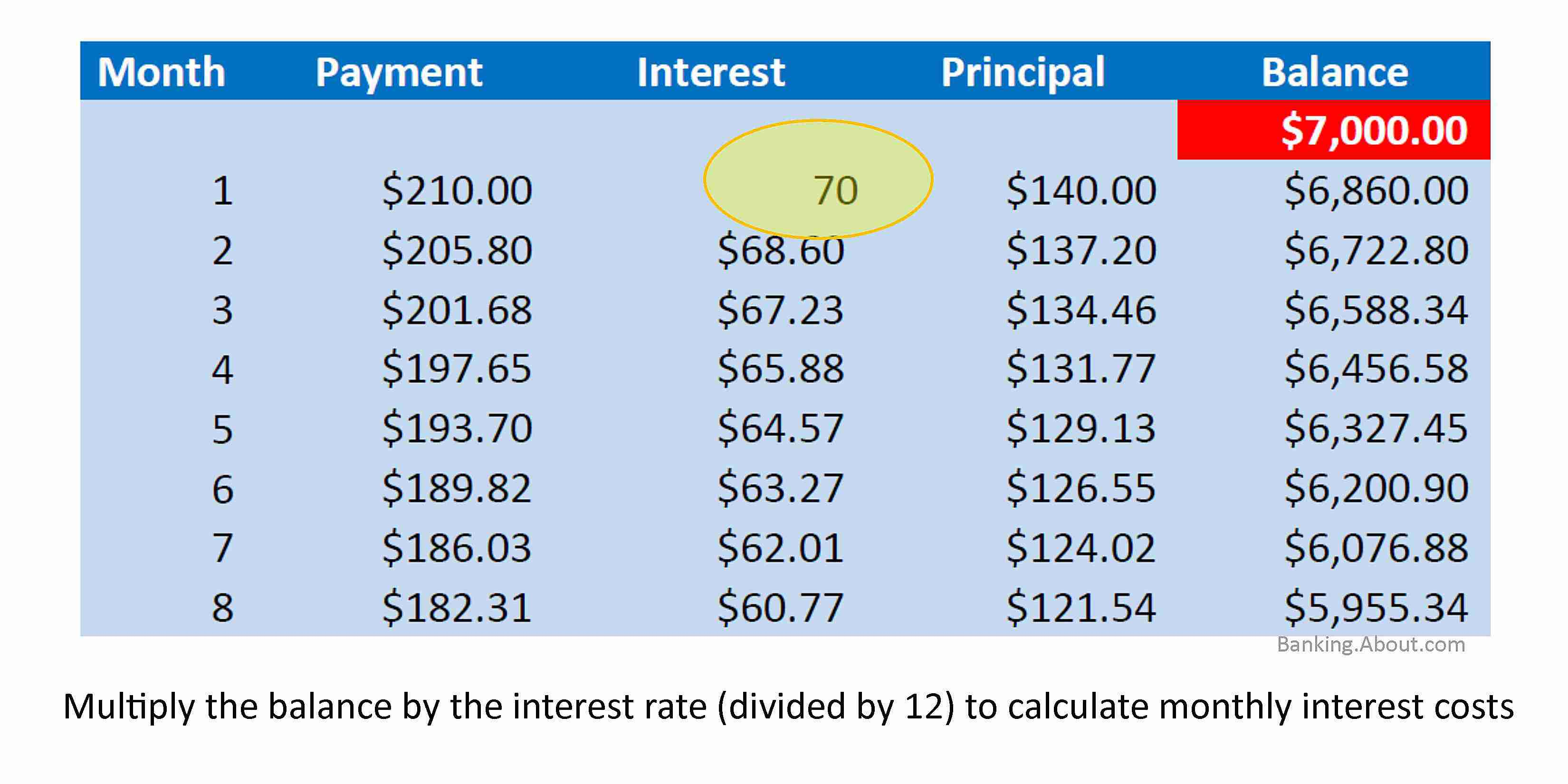

That have a conventional financial, the new resident acquire s money from the lending company to acquire otherwise refinance a property. At that point, the fresh new individuals then keeps a certain month-to-month homeloan payment (prominent & interest) on lender over a certain period of time or term. Popular terms and conditions try a great 15 or 31 season mortgages.

Contrary Home loan Credit line compared to. a home Security Financing

Contrary mortgages succeed the elderly to start a personal line of credit, or even take out a lump sum of money, up against its residence’s guarantee, going for accessibility tax-100 % free cash on security accumulated in their house. Essentially, reverse mortgages let the https://paydayloancolorado.net/shaw-heights/ homeowner to help you borrow against the fresh new security in their home. Their mortgage proceeds goes directly into the wallet to make use of however they wish to.

Reverse mortgage loans try book, as well as vary from a property equity line of credit, or HELOC, in certain suggests. When you find yourself both products allow resident in order to borrow against this new guarantee in their house, they must be an older to qualify for a reverse mortgage. Together with, having a beneficial HELOC, the cash they obtain includes at least monthly fees needs; while an opposing home loan personal line of credit lets these to put-off the installment. Which payment optionality element can result in a boost in cash disperse to have old age.

Conventional Mortgage

Conventional mortgage loans, also called antique mortgage loans and you will submit mortgage loans, are fund which do not wanted backing away from a federal government institution. Identical to reverse mortgage loans, conventional mortgages need the resident to pay possessions fees, home loan insurance premiums in the event the applicable, and you may homeowners’ insurance rates. But not, instead of a reverse mortgage, they are able to make an application for a traditional financial after they turn 18, given it match the conditions of its chose lender. Having traditional mortgages, the fresh new resident normally comparison shop and you may examine private lenders to acquire an informed mortgage arrangement you’ll.

Basically, except if the new borrower’s mothers gift them a free of charge-and-clear domestic in their tend to, or they struck silver inside the cryptocurrency or other providers, a vintage home loan remains the really date-effective way of making home guarantee.