Arizona, D.C. Past, You.S. Senator Sherrod Brownish (D-OH), President of one’s Senate Committee towards Financial, Casing, and you can Metropolitan Issues, along with Senators Jon Tester (D-MT), Chairman of your Senate Committee with the Veterans’ Points and a senior person in this new Financial and you will Housing Panel, Jack Reed (D-RI), an elder person in new Financial and you may Housing Committee and President of your own Senate Committee for the Armed Characteristics, and you may Tim Kaine (D-VA), a person in this new Senate Committee towards Equipped Attributes, urged Service away from Pros Products (VA) Assistant Denis McDonough to guard pros whom made use of their Virtual assistant household loan make sure take advantage of foreclosure.

Virtual assistant in earlier times offered remedies for assist consumers get-off forbearance and get back on the right track employing costs. But also for more than a-year, veterans haven’t had a practical choice to render its mortgages current, leaving all of them prone to shedding their houses.

[Tens] away from tens of thousands of experts and servicemembers remain and no feasible options to come back on course having money and you can cut its belongings. Reports away from nationwide reveal that this really is currently that have major outcomes getting veterans in addition to their parents, brand new Senators blogged. With each additional go out one to payday loan St Ann Highlands tickets, dangers mount to possess consumers who’re against property foreclosure because they waiting getting a simple solution away from Virtual assistant.

All this features remaining veterans and you can servicemembers with tough options than the options offered to individuals having Federal Casing Government (FHA) funds or funds backed by Fannie mae and you will Freddie Mac computer, that ensure it is borrowers to go missed costs to your prevent of title

I generate today urging the newest Company out of Veterans’ Activities (VA) to handle the possibility crisis against many experts just who made use of its Va financial guarantee work for. Brand new COVID-19 pandemic posed novel challenges to own scores of Americans, along with experts and you will servicemembers. Taking the fresh monetary weight that pandemic carry out cause of families, Congress acted rapidly within the 2020 to allow consumers so you can pause the mortgage payments without punishment. Va as well as acted quickly to apply that it forbearance and you may assure borrowers which they wouldn’t be needed to make up the overlooked money all at once when forbearance concluded.

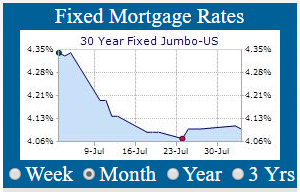

For a while, pros and servicemembers having Va loans did have the ability to disperse the individuals overlooked repayments towards the avoid of the mortgage label through the Veterans Guidance Partial Allege Commission (VAPCP) system. However, since the that program expired in the , veterans have not had a viable solution to give their financial latest and become inside their house. VA’s latest COVID-19 losses mitigation choice, the refund modification system, still means consumers to modify its finance and you may spend market interest levels, that makes it hard to lower repayments to possess borrowers just who gained off number-low-value interest money inside 2020 and you may 2021. However, also this one no longer is readily available, given that system is set so you’re able to end at the conclusion of the year, and servicers need certainly to stop offering an item in advance to be sure they’ve time and energy to over losses mitigation desires in the pipe.

Veterans and you may servicemembers which have Virtual assistant money just who encountered financial difficulties through the brand new COVID-19 pandemic put forbearance in order to stop its mortgage payments and get within their homes

I appreciate the main performs one Va keeps undertaken therefore the effort out of Va teams as they design and implement another type of losings mitigation services that may help you significantly more pros lower the payments and remain inside their land, despite the current high interest rate environment. Once readily available, the fresh new system you will definitely offer recovery to possess tens and thousands of individuals. Yet not, information the newest program’s terminology isnt yet , offered, and it will surely take time for lenders and you will servicers doing the brand new Va home loan system to apply the fresh new advice and commence offering this program. At the same time, thousands of pros and you will servicemembers are left with no viable choices to get back on track that have payments and you can cut their homes. Stories regarding nationwide demonstrate that this might be already which have significant effects for experts in addition to their household.

With each most time you to passes, dangers attach to possess consumers who will be facing foreclosure as they waiting to own a solution from Virtual assistant. We need you to stretch the available choices of brand new reimburse amendment program to be sure it is open to improve the consumers it normally. We also request that you head servicers to implement an immediate stop toward all the Virtual assistant mortgage property foreclosure where individuals will most likely qualify for VA’s the brand new Experts Advice Maintenance Get (VASP) system until its offered and you can borrowers shall be evaluated in order to see if it qualify. In the place of so it stop, tens and thousands of pros and you may servicemembers you are going to unnecessarily treat their houses owing to no fault of their own. It was never ever the intent out-of Congress. Simultaneously, i query which you bring all of us what resources or legislative alter are necessary to guarantee users of the Virtual assistant financial system is actually afforded an identical protections given that individuals with almost every other federally-supported money.