In certain circumstances, you could qualify for a unique financial a couple of many years once a property foreclosure. Nevertheless may need to wait longer.

A lot of people who have undergone a foreclosure wonder if the they are going to actually ever cashadvancecompass.com 10000 loan bad credit be able to pick property once more. Credit bureaus may report foreclosures on your credit history getting 7 age adopting the basic missed percentage one to led to the brand new foreclosures, longer if you find yourself trying financing to own $150,000 or higher.

But often, it could take lower than 7 decades to obtain a unique mortgage just after a property foreclosure. Committed you must waiting before getting an effective the new home loan utilizes the sort of financing as well as your economic points.

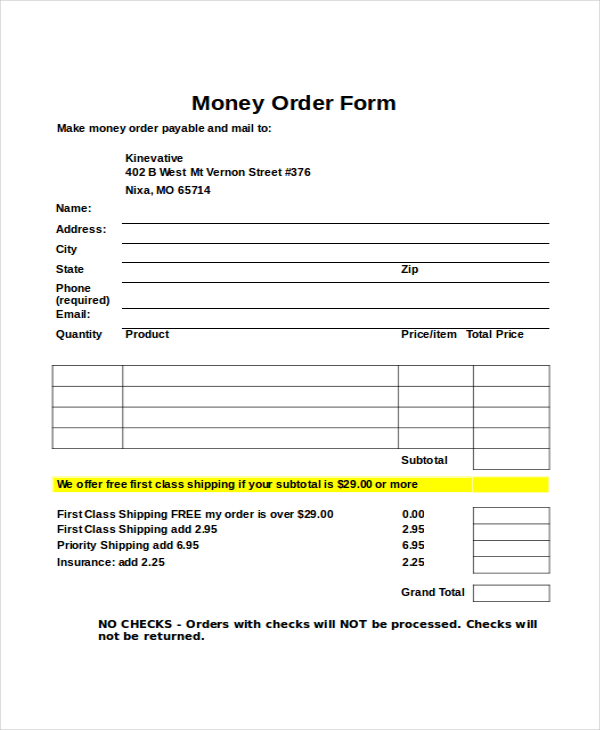

New chart lower than shows just how long the brand new waiting months try immediately following a property foreclosure for several types of financing, with increased details lower than.

And, a foreclosures can cause a life threatening lowering of your own fico scores, so it’s much harder to acquire a different financial. Exactly how much your own ratings usually slip depends on the potency of your borrowing from the bank in advance of losing your house. Should you have sophisticated borrowing from the bank just before a foreclosures, that is uncommon, your own ratings goes off more if you’d already had late or skipped costs, charged-of account, or any other negative items in your credit reports.

If or not you can buy financing, even with the fresh waiting months expires, relies on how good you have rebuilt the credit following the foreclosures.

Waiting Months having Federal national mortgage association and you will Freddie Mac Financing Just after Property foreclosure

Specific mortgages adhere to direction the Federal Federal Home loan Organization ( Federal national mortgage association ) while the Government Financial Mortgage Business ( Freddie Mac computer ) put. These financing, titled «old-fashioned, conforming» funds, qualify to be released to help you Fannie mae otherwise Freddie Mac computer.

Before , new prepared several months for another financing after the a foreclosures is 5 years. Now, so you can be eligible for financing around Federal national mortgage association otherwise Freddie Mac guidance, you need to always wait about eight many years just after a property foreclosure.

Three-Season Wishing Period For Extenuating Affairs

You happen to be able to reduce the prepared period to 3 many years, mentioned on the conclusion day of one’s foreclosure step, for a federal national mortgage association otherwise Freddie Mac computer financing when the extenuating issues (which is, a posture which had been nonrecurring, beyond your handle and you may resulted in an unexpected, high, and you will longer loss in earnings otherwise a devastating upsurge in monetary obligations) caused the property foreclosure.

- show your foreclosure are caused by extenuating products, such divorce, disease, sudden loss of household earnings, or job losses

- getting Federal national mortgage association, provides an optimum loan-to-value (LTV) ratio of brand new financial out-of sometimes ninety% and/or LTV proportion placed in Fannie Mae’s qualifications matrix, whichever was higher

- having Freddie Mac computer, enjoys a maximum financing-to-really worth (LTV)/full LTV (TLTV)/House Collateral Credit line TLTV (HTLTV) ratio of your lesser off ninety% or the restrict LTV/TLTV/HTLTV ratio into deal, and you may

- make use of the new home loan to acquire a primary home. (You simply cannot make use of the loan to buy the second family or money spent.)

Prepared Several months to have FHA-Insured Financing Immediately following Foreclosures

In order to be eligible for financing your Government Housing Government (FHA) means, you normally need to waiting at the very least 3 years immediately after a property foreclosure. The 3-year clock begins ticking in the event the foreclosure case is finished, constantly on the date your house’s label transferred because the an excellent consequence of this new foreclosure.

If the property foreclosure as well as inside it a keen FHA-covered financing, the three-year wishing several months starts whenever FHA paid the last financial to your its claim. (For many who treat your residence so you can a foreclosures although property foreclosure sales speed will not fully pay a keen FHA-covered loan, the lending company renders a claim to the FHA, plus the FHA makes up the lending company into losings.)