Georgia try a state having old-industry appeal that is available up to most of the area. Off Atlanta so you can Savannah, wonderful places and organizations was plentiful, each other big and small, and make «The fresh Peach Condition» one which will attract people of all ages. And with unmatched charm, there’s also much to accomplish. Away from function your landscapes into the popular pieces of art from the Higher Museum from Artwork so you’re able to taking a stroll from Savannah Historical District and you may seeking a succulent buffet at the a town solution, it southeastern state is truly exceptional.

Today, if you’re looking to-name Georgia home, you’ll end up pleased to remember that of numerous property opportunities arrive – the preferred getting mobile home. As his or her introduction in early 1870s, mobile land came a considerable ways to look at and you can capabilities – to such an extent you to some are actually mistaken for old-fashioned «stick-built» house. Of several earliest-time home owners is actually eyeing cellular residential property as his or her no. 1 desired mode out of property centered on the attainability and you can liberty.

What’s a mobile Home loan?

A cellular mortgage is actually that loan removed to order a mobile household, a kind of assets built in an environment-managed factory and later connected to the home, in the place of a traditional «stick-built» house. If in case considering cellular a mortgage choice, you will find different varieties of mobile mortgage brokers available, nevertheless the words can differ considering both lender and you can the borrower’s need.

When you take out a cellular mortgage, looking around and you may researching costs away from some other mobile house loan providers is actually important. And you can, without a doubt, you should also be sure you understand the small print ahead of signing people paperwork. Luckily for us, the latest mobile real estate loan lenders on Cascade Financial Characteristics is here to help make the techniques once the simple and you may transparent that you can, making your ideal to become a citizen alot more attainable.

Having a property in order to qualify for a cellular financial for the Georgia, our home must be considered a created domestic once the discussed of the the government. Because of this the home need started made in a great climate-regulated factory immediately following Summer fifteen, 1976, be at the least eight hundred square feet, immediately after which directed to help you its current area. Your house should also getting forever attached towards the land it consist into (therefore the loan must defense the newest property), can’t be situated in a cellular family playground, and possess the same places because a timeless family, instance running liquids and you will power.

If you are not knowing if for example the family you find attractive qualifies, you can always consult with your mobile home loan specialist at Cascade or perhaps the Georgia Company out of Neighborhood Situations.

What’s Necessary for Recognition with the a cellular Home loan in the Georgia?

Should your house you want to to finance matches Georgia’s official certification to have a mobile family, you’ll need to understand what’s required to become approved getting a financing. Depending on the form of cellular financial you will be trying to get, here is what you will need to has actually offered:

- A credit rating and you can history.

- A down-payment off step three.5% (Occasionally, no cash advance payment anyway!).

- Proof of earned earnings and you may work.

- A reasonable loans-to-money proportion.

- Zero a great judgments or bankruptcies.

- A reputable financial history.

- A co-signer may be needed if you don’t meet most of the requirements significantly more than.

If you find yourself this type of criteria might look daunting at first glance when capital a mobile domestic, it is important to remember that the cellular mortgage expert at the Cascade will help walk you through the method. Their pro will explain something that could possibly get angle suspicion, assisting you to achieve your requires.

Does Cascade Promote Used Mobile A home loan inside Georgia also as the The latest?

At the Cascade Financial Functions, we all know not people are searching for an effective new home. That is why you can expect put cellular a mortgage during the Georgia, also the fresh. These applications is of course much more restrictive. Like, a beneficial put mobile household is only able to end up being funded if it is forever connected with home (or perhaps is capable of being affixed) and also perhaps not started before gone. Pros could possibly get be eligible for a different in the event your possessions could have been went. We work on every credit systems and you can monetary records to get to the financing people will need because of their dream house.

What forms of Cellular Home loans Do Cascade Financial Characteristics Provide?

You have possibilities if you’re looking for mobile mortgage brokers within the Georgia. Various kinds money arrive, and each has its own gang of conditions and terms. Here is an instant writeup on the various loan types you might be eligible for:

- FHA Fund: The FHA financing is actually a national program giving casing recommendations so you’re able to reduced and you will moderate-earnings families. This new U.S. Department of Homes and you will Urban Innovation (HUD) administers the program. The FHA financing program can be obtained to all or any qualified borrowers who meet with the program’s advice.

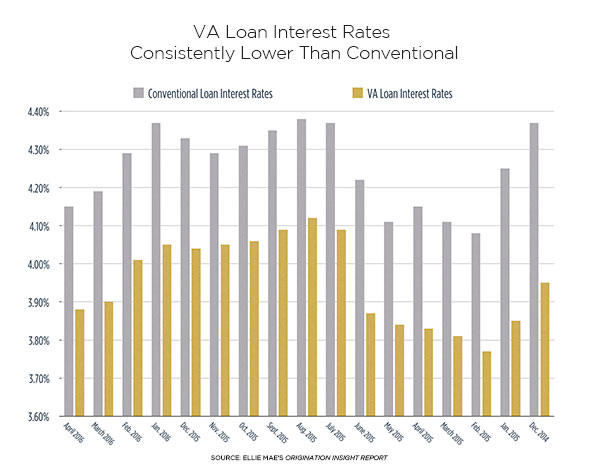

- Virtual assistant Loans: So it financing equipment just relates to being qualified productive duty provider participants and experts. The procedure is exactly like a classic home pick mortgage, and you can use your Va financing entitlement to find a beneficial are designed household. Still, you’ll need to and acquire a certificate of Qualification (COE) to locate which loan.

- Chattel Fund: Chattel fund is actually secured because of the mobile domestic by itself instead of of the belongings on which it is receive. For people who default in your loan, the lender is repossess the cellular family, not the latest land it is found on.

Mobile Mortgage brokers Are just a click the link Away

If you are searching to finance a mobile home in Georgia, the experienced class during the Cascade Monetary Functions is here to loan places Bay Pines simply help. Since the 1999, this new cellular household lenders in the Cascade have made it their objective to help you serve the fresh Western dream courtesy possible homeownership and now have complete therefore since that time.

Done the on the web pre-certification techniques otherwise call us during the (877) 408-6032 discover your cellular mortgage today!