Why are home loan cost large getting next property and you will investment services?

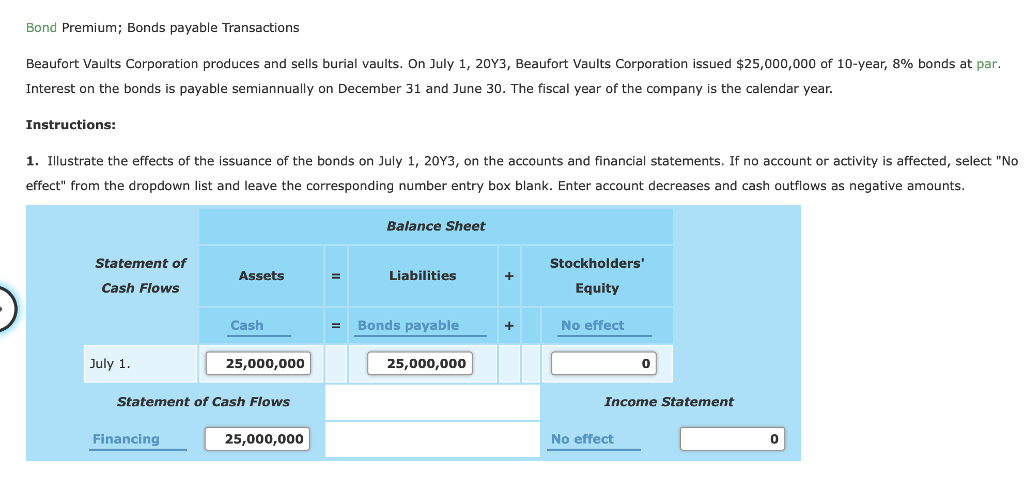

Minimal advance payment for a-one-tool, single-family unit members domestic, townhome, or condo money spent is actually 15% of the purchase price. For a few-to-4-product features, the brand new deposit risen to twenty-five%.

- 15% deposit is actually $75,000

- 25% downpayment was $125,000

Money spent-Minimum advance payment

You should use a normal mortgage buying a residential property. Lenders wanted good fifteen% advance payment having a-1-unit money spent and you may twenty five% to own a two-to-4-product.

You can not use bodies-recognized mortgage loans to purchase resource attributes. FHA (Government Property Management), Virtual assistant (Company of Experts Affairs), and you will USDA (You.S. Service out of Farming) fund is getting number 1 occupancy merely.

Home loan pricing are usually highest to have second belongings and you will capital characteristics than just number one homes because of increased chance items associated with the these characteristics.

Standard prices is actually large to the second belongings and you may capital functions, and thus travel family and you may leasing possessions finance are riskier to have lenders.

Loan providers know that for folks who fall with the hard times and need to miss an installment otherwise several, you can easily pay the financial on the dominating residence basic consequently they are expected to miss repayments on your own 2nd house.

How do loan providers determine if a property is an extra home or financial support?

Leer más