Assets Transformation

Our hefty refurbishment product is built to help possessions dealers and developers financing a restoration having speed. We could also More hints have money for the degree to save the costs down.

Second Charge

The next charge bridging loan may be the best service to have individuals who already have a home loan secured against their house however, need then loans to possess a short period of your energy.

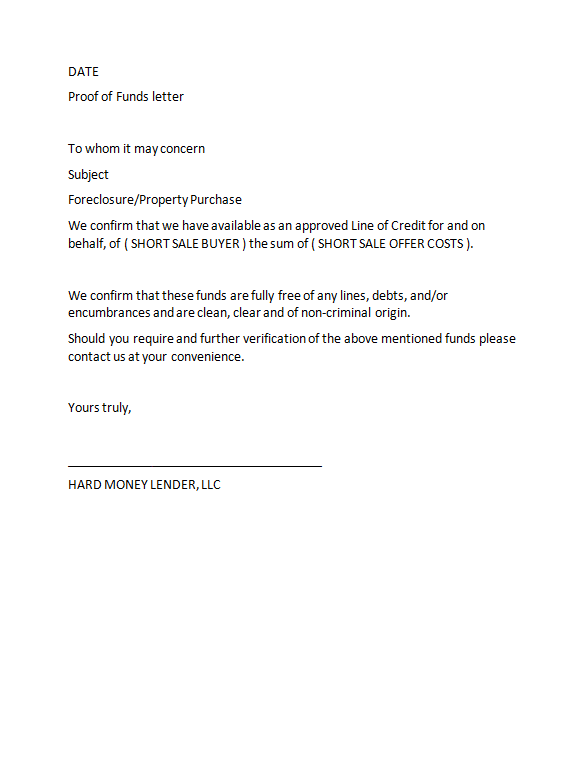

Property Purchase

A preliminary-title loan out of MT Finance is an excellent manner of raising funds rapidly, permitting landlords and you can assets investors to take benefit of financial support solutions regarding the pick-to-let market.

Business Investment

Whether financing are necessary to and obtain stock, give more financing so you can trigger growth, or even assists yet another campaign, MT Financing is actually invested in taking liquidity into the SME industry.

Immediate Transactions

We could generate financing decisions within this period off very first inquiry and you may launch money within just each week, stopping consumers away from missing big date-painful and sensitive solutions that can come the method.

Speed – The interest rate of funds is the chief advantageous asset of having fun with bridging funds, with package achievement tend to contained in this normally step one to six days. When compared with a consistent financial that will bring weeks and weeks to find a decision and you can done, MT Funds usually can render a sign words towards the a bridging mortgage in 24 hours or less.

The mission will be to help streamline the process for you because the rapidly you could, even though the doing all essential monitors you and also the assets. Very, when you have a home that is wanted-just after or becoming bought at a public auction, our team is preparing to help you done as quickly as you are able to.

End up being an earnings Visitors – Which have connecting fund, you are turned into a finances customer, letting you prevent the traditional delays from the possessions organizations and you can enabling you to complete towards a house instantly. That have organizations often being the major reason you to a house purchase is actually delayed, you can avoid lots of stresses to do the deal as soon as you can be – therefore it is perfect for property buyers, designers, and you can buyers.

Flexible Borrowing – Connecting funds reviews all of the candidate towards the a situation-by-circumstances basis, making it a great deal more approachable than just popular financial institutions and you can lenders. MT Finance might be able to grab a single look at a beneficial customer, their property as well as their history, which leads to getting far more bespoke words for you plus enterprise. Toward choice to use a large amount more step one so you’re able to 24 months, we have been pleased to give an adaptable arrangement to suit your standards.

Which are the Brand of Bridging Financing?

Unlock – That have an unbarred connecting mortgage it indicates your stop time or installment date isnt but really finalised. The get-off would-be so you’re able to redesign market the property in the a higher rates, although big date isnt yet , affirmed. In most cases you happen to be necessary to pay off brand new mortgage within 2 years or re-finance up until now significantly less than additional words.

Signed – That have a shut bridging loan, there’ll be fixed terminology and you may an obvious installment day. This can be regarding to get property using a market, purchasing a new household in advance of being able to sell your one if not transforming a house and renting it by way of buy-to-let.

First or 2nd Charge – MT Finance can offer connecting funds by way of earliest otherwise next charges. Given that earliest costs, it requires consideration because the first commission to-be accumulated out-of the house monthly. Once the second charge, this is actually the next concern in terms of repayments up against a house. When you yourself have an existing home loan, your bridging financing usually typically become your next costs, known as one minute home loan.