Good morning William, Your absolute best options for investment thereon age and you can standing out-of mobile house is to ask owner to create financing. Begin by choosing what type of down-payment and payment you really can afford right after which returning to the fresh amounts (note matter, interest rate, and you will identity) from that point. Try making the offer attractive to owner however, reasonable for you.

You will find a great 2010 hand harbor double wider household which is nevertheless financed courtesy 21st financial and i also have to sell it. What is the greatest route to begin attempting to sell it?

Keeps good 1969 twice-wider cellular home. Specific renovations in the home + an alternative roof. Have a double car garage. Situated on a large package during the North Ca. Paid off $85,000 are obligated to pay $39,000. Attention try eight%. Will there be anywhere that will re-finance my personal possessions and lower my interest. Thank-your.

Considering a great 1959 cellular home in the advanced standing who’s got already been refurbished and founded onto which have a permanent add-on and you can rooftop over the entire procedure here is the scrub it’s situated in an excellent go camping soil in which you rent your spot-on an annual foundation which domestic you are going to never be moved it offers full connect right up for water and you may electricity how would We procure a loan

my loved ones is wanting to offer 9 miles in the coastal northern Ca, the house or property keeps dos belongings and one 42 year old cellular domestic, I’ve been informed that you cant score resource on this subject property. would be the fact real even though there are a couple of most other house that commonly mobile homes?

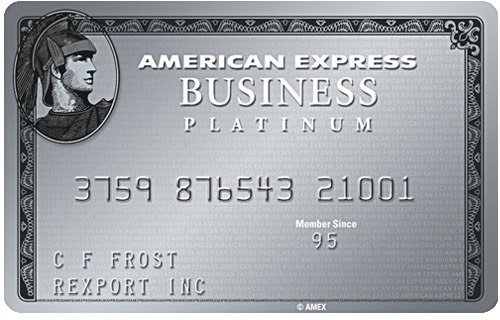

There’s a post out of Melissa (a reader in this new statements) you to mentioned twenty-first Financial just like the a chance to have old cellular family funds

Hi Christina, A traditional bank might not become any well worth to own this new cellular home in regards to the financing to help you worth (LTV) matter which they might be happy to provide on to own a beneficial customer. A mobile is often needed to be 2 decades old or quicker so you can he actually considered from the a collection bank. Without the almost every other dos residential property, it will be thought to be a clear piece of land, otherwise explore a private lende/investor Into the almost every other dos residential property, it could be bank financed that have a much bigger downpayment in order to make up the difference from sakes speed and also the matter you to the financial institution tend to finance. In the event your house is still offered please tell me because I am interested. Karen

I’m seeking to pick good 1979 twice large from inside the an excellent 55+ park the property owner questioned $19,000 Now i need pick others who will offer myself a financing, the home is during a advanced level updates. Brand new Port Richey, Florida.

Good morning Carlos, You could inquire the vendor to carry back an email. One other option is to track down a community personal individual you to definitely specializes in cellular home.

Cannot perform loan inside

We are seeking to get 1995 doublewide into step three acres. It is an effective repo very financial possess it. Indeed fanny Mae off Dallas is the owner of it. Will there be almost every other way we could get this to set?

21st Home loan does they! I purchased just one broad which was two decades old to the step 1 air-conditioning having $30K and so they did the borrowed funds. They were great and we also had no disease.

I have an enthusiastic 1976 double large cellular, funded because of the wellsfargo, and even refinanced because of the all of them. I invested a lot of money to help you refi loan places Newton and pay off bills, nowadays it said it actually was established 1 month too quickly. I wear the brand new roof, Screen, all metal products, one another refurbished baths, brand new flooring, etcetera., advertisements once nine months of documents, we had been denied. We’re to the a keen 8 pointfoundation, and possess been converted and you will pay taxation due to the fact houses. What can we perform ..how do we refi to expend costs, otherwise how can we sell. As i bought that it, I’d little idea ones regulations, whilst is conventionally funded! Any recommendations liked.