Ads Requirements to have House-Covered Credit

Lower than Controls Z, advertisements to have signed-prevent borrowing from the bank secured because of the a home was subject not just to what’s needed chatted about previously but to a lot of other conditions also.

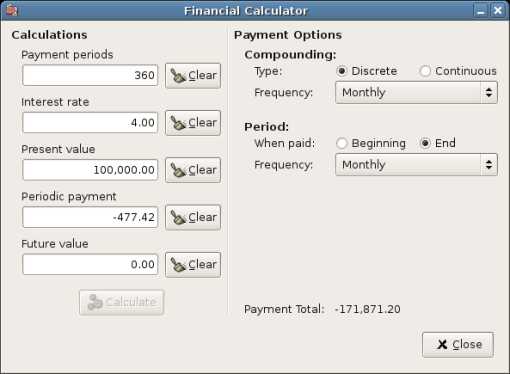

Disclosure of pricing and repayments. To possess varying-price loans, the fresh new creditor is divulge a fairly newest directory and margin. In addition, brand new ad should include the time period for every price have a tendency to apply and the Apr into mortgage. 38

After that, whenever a promotion to have a dwelling-safeguarded mortgage comes with money, it ought to range from the level of for each and every percentage which can implement over the term of the mortgage, and people balloon money. 39 Having advertisements regarding changeable-rates financing, a rather most recent list and margin accustomed influence the latest payment need to be shared.